7 THINGS YOU MUST DO TO AVOID LIVING WITH REGRETS AFTER RETIREMENT

Having worked in the Finance and Accounts Department for over six

years I have observed that many people spend their entire working years without

understanding what retirement actually looks like. Although they know for sure that

one day they will retire but they unconsciously do not wish to talk more about

it, instead, they believe that when they get to the river, then they will find

out how to cross it. The most unfortunate thing about retirement is that, it

happens at the time that many people are never prepared.

The biggest regrets which to me is the most painful in life is not

about the things we didn’t do right during our working life but it’s about the

things we failed to do. If you fail or

miss an examination, there could be a second chance to rewrite it but, what makes

retirement regrets so painful is that, there is no chance to re-do your

mistakes.

These are the kind of regrets that we witness often at the finance

and accounts department. Such unfortunate experience came as a big shock to

many retirees and many have died as a result of it.

The falling of a dead leaf, they say is a warning to the fresh

ones up there. So, I have decided to share with you these 7 essential things

you must do today to avoid living with regrets after retirement. What I am

about to share with you are some of the actions which many retirees failed to

take while they were still working which they are regretting about today.

1.

EXPECTING UNREALISTIC BENEFITS: One of the biggest mistakes of

most retirees which you must avoid is expecting unrealistic retirement

benefits. Many people today still do not understand the new pension scheme in

Nigeria. They just believe that it is the same or even better than the former

pension scheme where you will earn a pension after retirement till death comes.

Today, your pension is determined by what you have in your Retirement Savings

Account (RSA). Again, you must know the various types of investments that your

Pension Fund Administrator (PFA) are authorized to invest your money in and

their respective rate of return so that you would not be expecting that balance

in your RSA to be doubled at retirement.

2.

NOT FINISHING WHAT YOU STARTED: One of the sources of regrets for

most retirees is having many unfinished projects at the point of retirement. This

is usually attributed to procrastination or lack of seriousness. To avoid

falling into this same pit, you must stop living with the assumption that better

times will come in the future, try to always make the best use of the time you

have and never push anything to an uncertain future date. Such better time may

not come again. Think of those things that you must do now like getting more

education, learning extra skills, writing that book, etc.

3.

NOT PURSUING SELF DEVELOPMENT

WHILE AT WORK: Many people go

to work simply to make a living thus, they work so hard so as to make more

money. But according to Jim Rohn, “If you work hard on your job you can make a

living, but if you work hard on yourself you'll make a fortune.” So, do not

retire exhausted and useless but develop yourself to become more skilled and an

expert so that you retire being more valuable. I have seen some people who

retire and become more successful than they were while working.

4.

NOT TAKING STEPS TO DEAL WITH A

BAD HABIT EARLY ENOUGH:

Many people, while at work have been carrying on with certain bad habits which

are detrimental to their health and financial wellbeing but they do it as means

of socializing with colleagues. For instance, drinking of alcohol, smoking, clubbing,

womanizing, gambling, etc. While it is OK to indulge yourself in whatever past

time you choose, many people fail to calculate the costs. When retirement suddenly

comes, doing away with such habits becomes a big challenge, most times; some

irreparable damage would have been done. While you are enjoying the flow, always

remember that the choices and decisions you make now will affect the rest of

your future.

5.

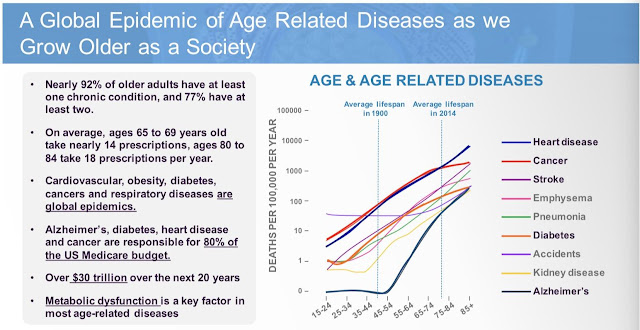

NOT TAKING GOOD CARE OF YOUR

HEALTH AND WELLNESS: It’s just unfortunate

that many people would have exhausted all their useful life while working; at

the time of retirement they are already battling with one or more chronic

illnesses. This is very common among people living in our cities where many

workers barely sleep up to 5hours daily; they wake up as early as 4.00am to

prepare for work and sometimes get back home around 10.00pm due to heavy

traffic. This also affects their diet; they are often compelled to eat whatever

is readily available not minding whether it’s a healthy diet. Many of them are

even so impoverished to an extent that they do not wish to spend a kobo for regular

medical checkups or buying nutritional supplements. They spend their health

pursuing wealth and after retirement, they will be compelled to spend all their

past savings pursuing their health. The best way to avoid this retirement

mistake is to remember that your health is your only true measure of wealth, so

take good care of yourself.

6.

YOU MUST HAVE A RESIDUAL INCOME: No matter the amount of money

that you are earning today, once you retire the income stops. Also, no matter

the amount of money that you have in your Retirement Savings Account, as long

as nothing is adding up to it after your retirement, the money is sure to be

exhausted perhaps sooner than you anticipated. That is why you need to have a Residual

income. This is also called passive, or recurring income, it is an income that

keeps coming in even when you have stopped working. Unlike other sources of

income like salary, commissions, wages, rent, interests, etc; residual income makes

you to continue earning from your initial efforts, while gaining time to devote

to other things... such as generating more streams of residual income. This is

the ultimate retirement plan that you must consider.

7.

PLAN! PLAN!! PLAN!!! Planning is everything about

retirement; you must not fold your hands believing that things will just work

out perfectly well for you on their own. You must start planning for your

retirement from the very first day that you start working. You must consider

the fact that, most times after retirement your living expenses might even

become higher. Waiting until you get your benefits before making your post

retirement planning is not the best decision to make. It is like waiting until

the boat start sinking before learning how to swim. That is why you must

consult a professional to help you develop a concrete and realistic retirement

plan to guide you so that retirement will not be a nightmare but a journey to

freedom and a new lease of life.

PROJECTRISE offers free counseling in retirement

planning and they also offer training on how to build residual income that last

you all through life and even outlive you. Their training is free but you must

be referred to attend. To get a Referral Code contact me on:

TELEPHONE: 08052833097,

09097917225

WHATSAPP:

08033291724

E-MAIL: thinkingminds@ymail.com

BLOG: http://healthandmicrobusiness.blogspot.com.ng

Comments

Post a Comment